We take you on from scratch…

And we create the technological and human infrastructure to manage an immense volume of loans with the minimum possible effort.

Online marketing

Online marketing

At Solicorp, we help drive demand for fast loans to our lenders’ websites.

Using optimized Google advertising campaigns, we redirect hundreds of new customers every day.

On top of this, we have strategic collaborations with other providers of fast loan customers. This ensures a constant influx of people interested in loans, which in turn provides increased visibility for lenders.

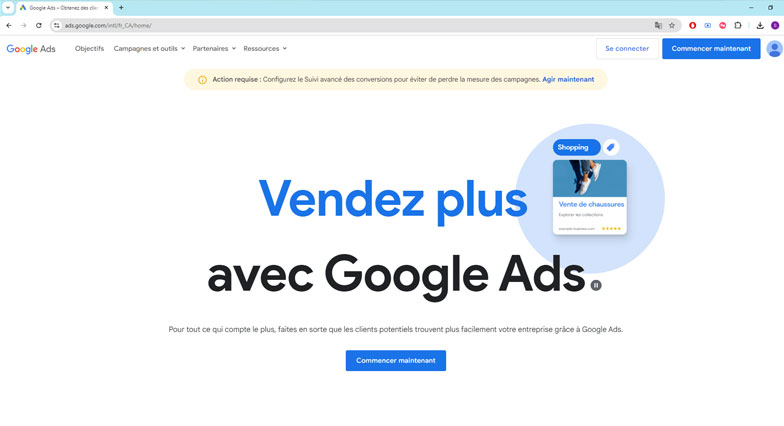

Web portal for customers

Web portal for customers

Each lender has a website where customers can submit their loan applications.

The procedure begins with the submission of a basic information form, followed by bank verification using IBV technology.

The customer then awaits a positive response.

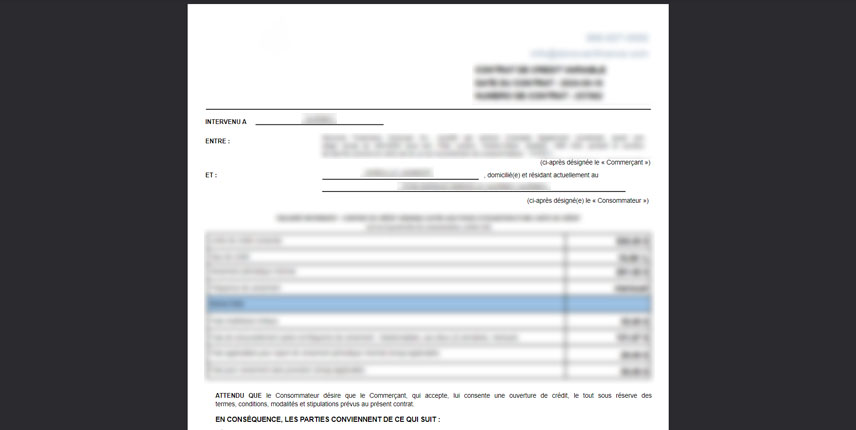

Once the loan has been approved, the customer signs the contract directly on the platform.

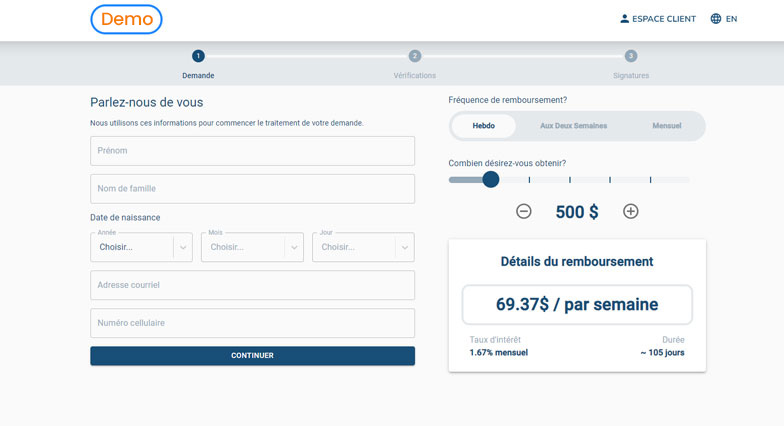

Approval interface

Approval interface

This module enables you to monitor the status of customers and access their information: amount requested, bank verification via IBV, signed documents, etc. An integrated communication system enables customers to be contacted by telephone or SMS without leaving the platform.

Approvers can also check customers’ viability by consulting their banking history and their interactions with other lenders. Once approved, contracts are generated and signed electronically, and funds are transferred to the customer at the click of a button on the platform.

Loan servicing

Loan servicing

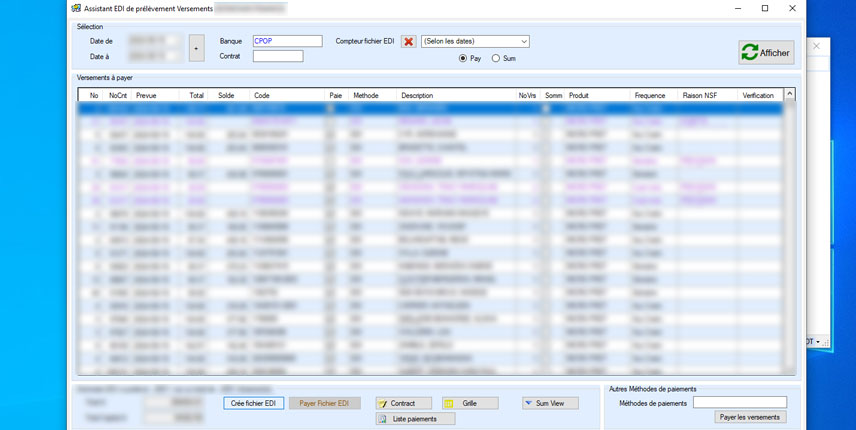

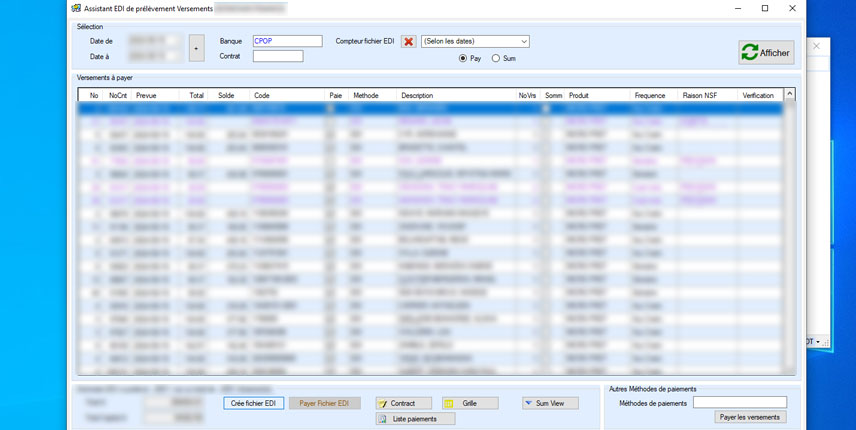

Once the money has been disbursed, it’s essential to receive payments on time. Customers are therefore imported into the direct debit system, with their own payment schedule. The Direct Debit Wizard makes it easy to manage the transactions to be made each day. The lenders send an EDI file to the bank, which collects the amounts directly from the customers.

A few days later, the bank sends back a file indicating the payments made, as well as any incidents such as NSFs or stop payments. This file is used to update the accounts and transfer customers in difficulty to the collections module.

Collections

Collections

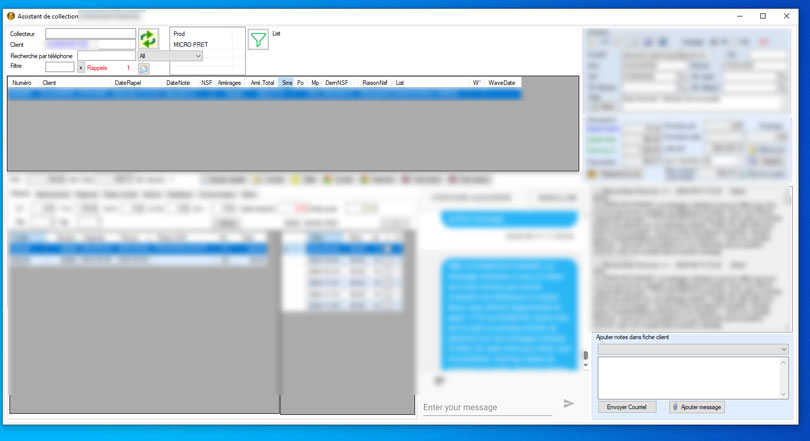

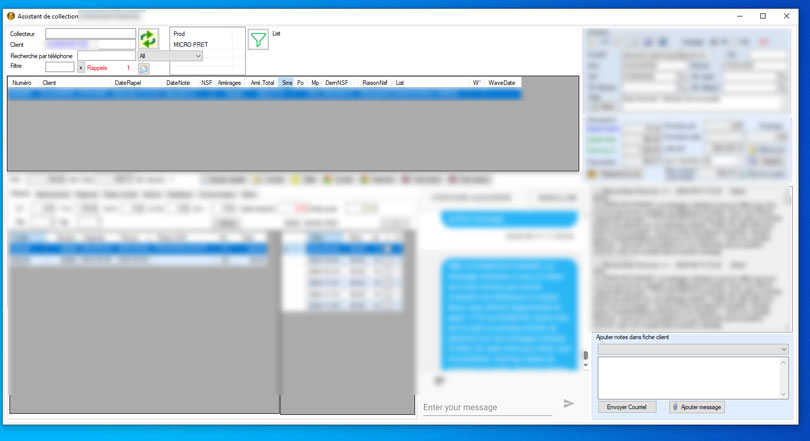

The collections wizard lets you manage customers in default of payment. It provides a list of customers with unpaid direct debits and access to their complete information, such as loan amount and payments made.

Collectors can view communication history, call or text directly via the platform, and see all interactions, which are recorded. They can also view customer references and contacts.

The tool offers the possibility of helping customers to pay by proposing various options, such as deferring or recalculating payments, to maximize the chances of recovering funds.

Accounting and reporting

Accounting and reporting

Our lenders do more with less

Manage a huge portfolio of loans much more easily with our advanced modules and features.

From approval, to management, to accounting, to collections, we build the most robust lending systems on the market.

What’s more, we constantly coach our lenders with our experienced team. We offer training and support in the optimal use of the modules.

Opt for complete digitization to minimize manual tasks and maximize your profits

Understand the complete system

Online marketing

Online marketing

Before applying for a loan, potential customers need to be redirected to our website.

The good news is that there’s a steady stream of customers looking for fast loans. The demand is there and it’s huge. What we need to do is redirect it to our loan application pages.

At Solicorp, we help you redirect this demand to your website using Google ads. We create hyper-optimized campaigns that bring customers back again and again.

What’s more, we have strategic alliances with several other providers who bring us customers looking for loans, such as Prêt Instant. This creates a constant flow of customers to our lenders’ sites.

Online marketing

Online marketing

Before applying for a loan, potential customers need to be redirected to our website.

The good news is that there’s a steady stream of customers looking for fast loans. The demand is there and it’s huge. What we need to do is redirect it to our loan application pages.

At Solicorp, we help you redirect this demand to your website using Google ads. We create hyper-optimized campaigns that bring customers back again and again.

What’s more, we have strategic alliances with several other providers who bring us customers looking for loans, such as Prêt Instant. This creates a constant flow of customers to our lenders’ sites.

Customer web portal

Customer web portal

Each lender has a website with their own domain name where customers can apply. This is the starting point of the system.

When a customer wants to apply for a loan, he goes through several steps. They start with a form with their basic information, do their bank verification using IBV technology, and then wait for the approver’s response to their application.

Once the loan has been approved, the customer can then sign the contract directly on the platform.

This is the beginning of the approval process, and this is where our system starts to help enormously.

Loan application – Approval interface

Loan application – Approval interface

Each approver has two main goals:

- To have as many customers as possible approved.

- To reduce the number of customers with potential problems.

Since these two goals somewhat counter each other, it’s necessary to have the tools to help make the best possible decisions.

Instead of having to go to different locations, use external communication systems, and juggle different software, everything is available in one place. This makes the approvers’ job much easier.

Approval status and customer information

The approval interface shows us the different stages our customers go through and their status. Some are being verified, some are accepted, some rejected, etc. If we enter each of these categories, we get a list of the respective customers.

The approver can therefore make the necessary checks, contact the customer and his references, and then decide whether or not to approve him very quickly. All customer information and communications are available in one place.

For customers who need to be approved, all the work is done on a single page. We have access to the module that allows us to see:

- The amount requested

- Their basic information and identity documents

- Their IBV verification

- Information available on them from other lenders

- Their signed documents (terms and conditions, signed loan contract)

Approval status and customer information

The approval interface shows us the different stages our customers go through and their status. Some are being checked, some are accepted, some rejected, etc. If we enter each of these categories, we get a list of the respective customers.

The approver can therefore make the necessary checks, contact the customer and his references, and then decide whether or not to approve him very quickly. All customer information and communications are available in one place.

For customers who need to be approved, all the work is done on a single page. We have access to the module that allows us to see:

- The amount requested

- Their basic information and identity documents

- Their IBV verification

- Information available on them from other lenders

- Their signed documents (terms and conditions, signed loan contract)

Phone & email system

We have a telephone system integrated directly into the system.

Each approver can therefore call and text with the customer and his references directly in the platform with a single click.

There’s no need for the approver to use an external telephone or communication system – everything is in the platform. He can send pre-prepared SMS messages to the customer with the status of his request, if he needs further information, changes, etc.

What’s more, the approver can see all his past communications with the customer, and quickly know everything he needs to communicate with.

In-depth information on customer viability

Customer viability is paramount. That’s why we have a number of modules that help enormously with approval.

IBV technology

The first is IBV verification. IBV allows our lenders to see the customer’s bank account history to make their lending decision.

On our platform, we have a color-coded legend that shows us if the customer has negative balances, payrolls, NSFs and stop payments, existing loans, and so on. The approver can therefore see potential problems and make decisions quickly.

Loans from other lenders

Each customer has a tab called “Other Lenders”. If the approver clicks on it, he’ll see if the customer has had loans with other lenders, and if he’s creating any problems.

The approver can see if the customer’s information (phone, email, address) remains constant with other lenders.

What’s more, he can see his loan history, whether or not he’s been approved and for what reasons, whether he has a lot of late payments, and so on.

This prevents loans being given to people acting in bad faith, and goes a long way to improving the customer selection process.

Contract approval and signature

Once the customer has been approved for a loan, the approver changes the customer’s status and marks him/her in the system as a current customer.

The system automatically creates the customer’s contract with all his information and sends it to him for electronic signature.

Once the customer has signed his contract, he moves into the disbursement category. The approver can then click to send the money to the customer. The system then sends it directly from the lender’s bank account to the customer’s.

The whole process takes place on the platform, from signing the contract to disbursing the money. This is the end of the approval process.

Loan maintenance

Loan maintenance

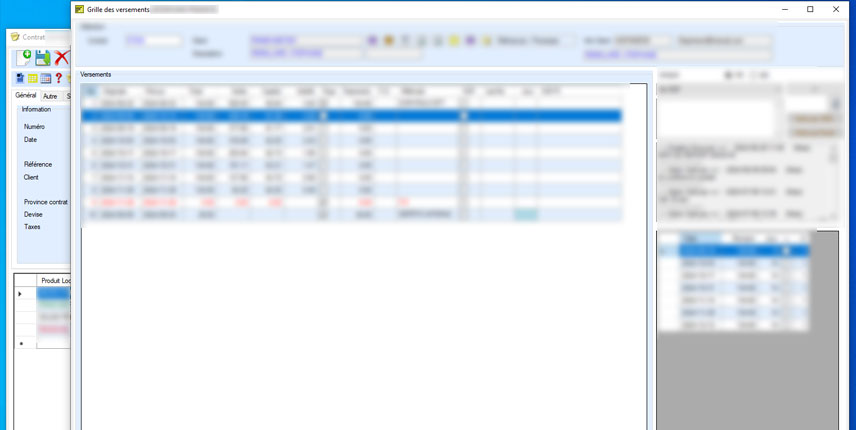

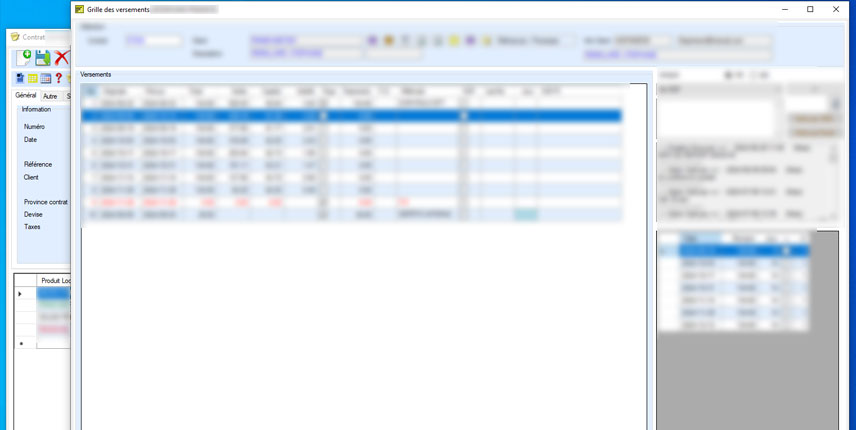

Once the money has been disbursed to the customer, it’s important to start receiving payments on time.

Once the customer has been approved, it must be imported into our direct debit system. Each imported customer has its own payment schedule.

Our Direct Debit Wizard shows us a list of the direct debits that need to be made each day, and allows us to make them en masse.

Each day, our lenders create an EDI file and send it to the bank. The bank can then debit the customers directly, and we know which customers have paid and which have problems.

Several days later, the bank sends us another file with what has been debited for that day. This file also shows us which customers have NSFs and stop payments at the bank. This file will then help us to re-configure the accounting and reverse scheduled direct debits, but also to push customers with problems into our collections module.

Once the money has been disbursed to the customer, it’s important to start receiving payments on time.

Once the customer has been approved, it must be imported into our direct debit system. Each imported customer has its own payment schedule.

Our Direct Debit Wizard shows us a list of the direct debits that need to be made each day, and allows us to make them en masse.

Each day, our lenders create an EDI file and send it to the bank. The bank can then debit the customers directly, and we know which customers have paid and which have problems.

Several days later, the bank sends us another file with what has been debited for that day. This file also shows us which customers have NSFs and stop payments at the bank. This file will then help us to re-configure the accounting and reverse scheduled debits, but also to push customers with problems into our collections module.

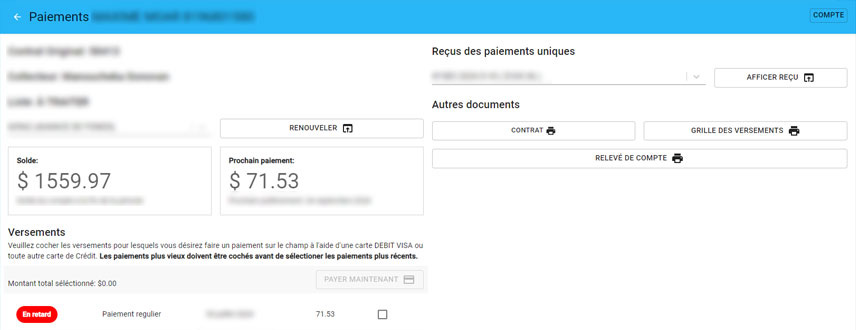

Customer portal

To avoid wasting time with too many calls, customers can access their account directly on the lender’s website.

He can see his remaining balance, overdue payments, online payment for credit card arrears, and a report of previous payments.

All this makes his real-life situation easy to understand, and helps him to optimize and re-plan his payments.

Collections

Collections

Our collections wizard helps us manage problem customers. This is where collectors need to recover as much money as possible and exit at a profit with customers who refuse to pay.

Just as in the loan management and direct debit modules, we can see a list of customers who have suffered unpaid direct debits in the past.

If the collector clicks on the customer, he can see all his details, including the amount of his loan, how much he has already paid, and so on. The screen also allows us to see all communications with the customer, and to text and call directly. All calls are also recorded in the platform, and references and other contacts can be viewed.

Finally, the collector can help the customer pay in a variety of ways. He can defer, re-calculate payments… And give customers chances to pay in different ways.

Collections

Collections

Our collections wizard helps us manage problem customers. This is where collectors need to recover as much money as possible and exit at a profit with customers who refuse to pay.

Just as in the loan management and direct debit modules, we can see a list of customers who have suffered unpaid direct debits in the past.

If the collector clicks on the customer, he can see all his details, including the amount of his loan, how much he has already paid, and so on. The screen also allows us to see all communications with the customer, and to text and call directly. All calls are also recorded in the platform, and references and other contacts can be viewed.

Finally, the collector can help the customer pay in a variety of ways. He can postpone, re-calculate payments… And give customers chances to pay in different ways.

Accounting

Accounting

All accounting is automatically created in the system.

Firstly, all the bookkeeping is done with our direct debit files that we send to the bank, but also with the files that the bank returns with the status of the transactions. Everything that goes in and out, and then has to be adjusted, is entered directly into the system.

Afterwards, we can also make adjustments and manage payroll and other financial requirements directly from the system.

At the end of the fiscal year, all the bookkeeping is done, and we can bring out the final financial results. What our customers have to do is go to their accountant and give them the money to do the corporate tax returns.

Accounting

Accounting

All accounting is automatically created in the system.

Firstly, all the bookkeeping is done with our direct debit files that we send to the bank, but also with the files that the bank returns with the status of the transactions. Everything that goes in and out, and then has to be adjusted, is entered directly into the system.

Afterwards, we can also make adjustments and manage payroll and other financial requirements directly from the system.

At the end of the fiscal year, all the bookkeeping is done, and we can bring out the final financial results. What our customers have to do is go to their accountant and give them the money to do the corporate tax returns.

Before technology… service

Before technology… service

Our team isn’t just here to implement software, we’re here to help you run your company as efficiently as possible.

We’re located on Montreal’s South Shore. Our team is available to help you from 8 a.m. to 6 p.m. Monday to Friday, and weekends on request.

We offer a wide range of services, including installation, training, process improvement and software customization.

We take care of you in terms of both software and people, and are your allies in managing your business.

Why opt for efficiency and digitalization?

Consolidated customer information

All customer information is available in one place, enabling loan decisions to be made much more quickly.

This applies to approval and collections.

Centralized communications

All communications with customers take place on the platform, with a history accessible at all times.

Approvers and collectors can therefore call and text customers directly on the platform, and view the history of past conversations.

Flexible integrations

We integrate with a wide range of companies, from telephony and IBV technology to credit bureaus and banks.

All these integrations make it easy to use all our modules and speed up approvals and collections.

Clear, real-time reporting

All our lenders have access to accurate reports that show the company’s figures in real time.

This helps to find and predict problems quickly, and eradicate them in time.

The Solicorp implementation process

We make the process easy and guide you every step of the way:

Needs analysis

We’ll take a look at how your business operates and determine what you need to improve.

Design

We work with you to create a plan tailored to your business. We test them together for feedback

Development

We build and test the software to make sure it works perfectly for you.

Deployment

We install the ERP, transfer your data and train your team to use it easily.

Ongoing support

Even after installation, we’re here to help, troubleshoot and add updates as needed.